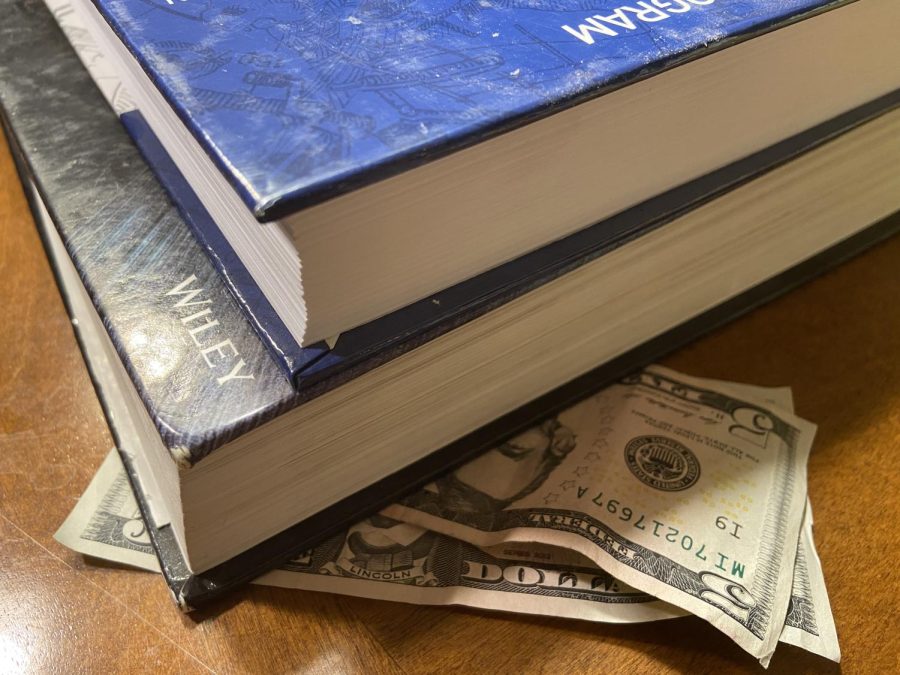

What should the government do about student debt?

While students are excited to pursue higher education in college, student debt is a source of stress and struggle for many.

May 27, 2022

Student debt is a pressing issue in the US today — over 45 million people now owe a total of over 1.7 trillion dollars of debt. With the average student debt increasing from $24,700 to $36,800 in the last decade, there has been a push for President Biden to cancel or relieve student loans. If enacted, a relief program can benefit Amador senior students, who are about to start college.

“’I will have to figure out, somehow, to cover about 300k by the time I graduate, so I am worried about debt in college,” said Arthur Hua (22’).

Ever since his inauguration, President Biden has voiced his support to cancel $10,000 in student debt for all individuals.

“I definitely think that the currently proposed debt relief of 10k is a good idea, I think it’ll be a huge help for other students like me who will be suffering worrying about student debt,” said Hua.

However, the disparity in student debt for different income brackets is significant. The top fifth of households holds 3 times as much student debt as the bottom fifth. In addition, graduate students account for a whopping 37% of all student debt, and they often earn degrees and go on to obtain high-income jobs.

“I am not worried about debt because I am going into computer science, which has good job prospects,” said Richard Li (22’).

Relieving student debt equally for all income brackets will disproportionately benefit the rich and those with profitable careers, who most likely don’t even need the relief.

Even if debt relief is targeted at low-income students, hundreds of billions of dollars will be needed. This will certainly worsen the already-concerning inflation and also increase taxes. Government relief can also encourage students to borrow more money and make risky financial decisions, and worst of all, colleges will be incentivized to charge more.

“I think decreasing college tuition is a better idea than government relief because many countries like Canada have great public universities which are affordable to everyone,” said Li.

However, the older generations might be willing to sacrifice a bit for the education of their children.

“Education is very different for older and younger generations. I think that there would be many people supporting a government relief program because people had to pay tuition for their kids and know their struggles,” said Kai Gottschalk(22’).

What about the students that are struggling every day to make ends meet? The government is already taking numerous measures to help them. When Covid hit, Biden instated a moratorium on all federal debt, pausing payments and interest. This has cost $100 billion and canceled the equivalent of $5,500 in debt per student.

There are also income-based repayment plans, which cap the monthly payment to a certain percentage of the income of low-income students. For many below the poverty line, this means close to no payments. Any amount that is not paid by the end of the repayment period is forgiven.

Students also have the option to cancel their entire debts with the Public Service Loan Forgiveness (PSLF). This program forgives student debts if students work full time for a government agency, such as the conservation corps, and pay 120 payments towards their loans.

These methods of debt relief provide significant help, but many are not informed about them. For example, only 43% of students know about income-based plans. Instead of pushing for more debt relief, the government should do all they can to ensure public awareness of these programs

Another action that can relieve debts without public discontent is to lower the interest rates. Federal student loan interest rates will range from 4.99% to 7.54%, after the increase this July. These interest rates are much higher than the prime rate of 4%, which is what banks charge most corporations, and many are criticizing them as unfair. Lowering interest rates and refunding extra paid interest will significantly help students.

However, college is a form of educational investment after all, and with investments come risks.

“I view college as an investment as it will help me achieve my dreams, and even if I don’t end up in academia as I wish, I can still get a job for my major,” said Li.

The government should help struggling students, but it should not cancel debt for the typical student, and instead use milder methods like repayment programs or lowering interest.