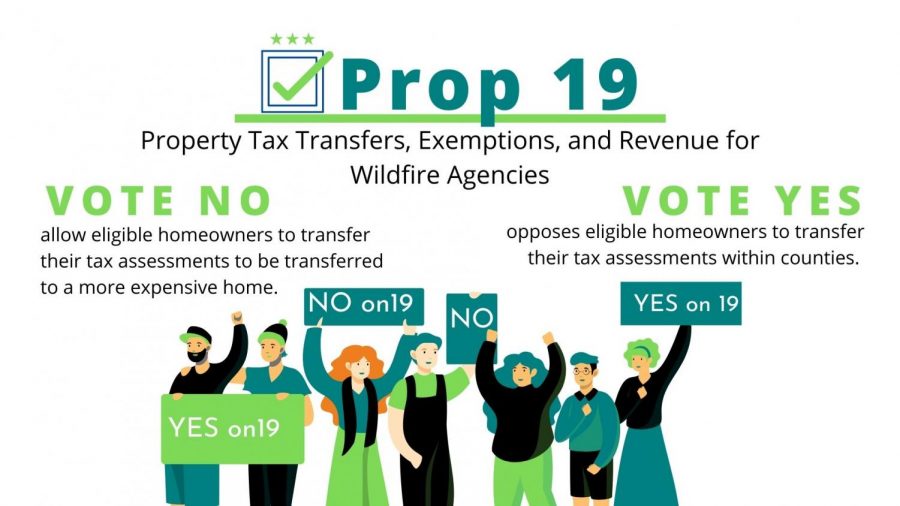

Prop 19: Changes certain property tax rules

Prop 19 would change certain property tax rules.

November 1, 2020

Overview

Proposition 19 focuses on tax breaks for California citizens who are of ages fifty-five and older. It allows them to buy a second house and pay the same property tax as their first house.

Yes

Prop. 19 benefits senior citizens, wildlife refuges, and disabled homeowners by offering them a way to maintain their savings in California’s increasingly expensive housing market. Abdul Mohammed(21’), an Amador Valley student, supports Proposition 19 for this reason.

“I support Prop 19 because it provides relief for many wildfires victims as It eliminates unfair property tax rate hikes when they are relocating; Allowing them to transfer their tax rates from their old damaged home to a new replacement home without any penalties. Also, it will help close unfair tax loopholes abused by many celebrities, heirs, and investors. They game the system to avoid paying high taxes, forcing the middle-class to pay taxes that are ten to twenty times higher even though they live in the same neighborhood,” said Mohammad(21’).

Voting “yes” on this proposition would also require those children who inherit houses from their parents to pay the current property tax value. Nitya Sunkad(21’), a soon-to-be Amador graduate, believes this is beneficial, as it allows funds to be reallocated.

“I support Proposition-19 because I disagree with letting businesses get away with paying property taxes way lower than the market value. Prop 19 can close the loophole keeping those taxes artificially low and use those funds on efforts like fighting fires, which California desperately needs,” said Sunkad(21’).

No

The disadvantage of voting “yes” on Prop. 19 would be that children would have to spend much more on property taxes. However, this is one benefit of voting “no”, as it reduces the burden on future generations. Children who inherit property would pay the original property tax at the value their parents paid for.

Like all ballot measures, there are two sides to the story. A “no” vote also means that most disabled, elderly, and refugee homeowners would not be eligible for property tax savings if they move.